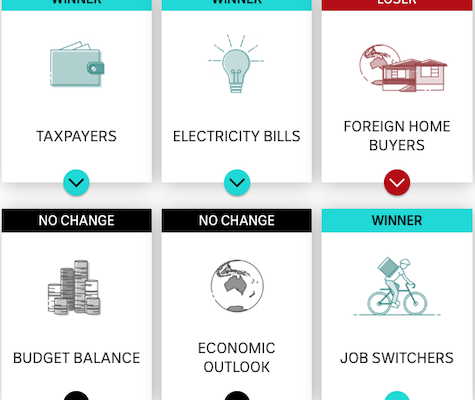

Winners and Losers – Federal Budget 2025-26

Treasurer Jim Chalmers has handed down his fourth federal budget, laying the groundwork for a federal election campaign that could be called within days.

What does the proposed changes to HELP loans could mean?

If you are one of the millions of Australian with Higher Education Loan Program (HELP) debt, the proposed changes may offer some benefit.

What does the proposed changes to HELP loans mean?

If you are one of the millions of Australians with Higher Education Loan Program (HELP) debt, the proposed changes may offer some benefit.

https://jimsbookkeeping.com.au/wp-content/uploads/2025/03/tax-deduction-legislation-undermining.jpg

267

400

https://jimsbookkeeping.com.au/wp-content/uploads/2019/10/Jims-Bookkeeping-logo-updated-2019-2.png

2025-03-23 00:00:002025-03-03 16:35:50Tax planning tips for 2024-2025

https://jimsbookkeeping.com.au/wp-content/uploads/2025/03/tax-deduction-legislation-undermining.jpg

267

400

https://jimsbookkeeping.com.au/wp-content/uploads/2019/10/Jims-Bookkeeping-logo-updated-2019-2.png

2025-03-23 00:00:002025-03-03 16:35:50Tax planning tips for 2024-2025

Tax Office puts contractors on notice over misreporting of income

The ATO's data matching programs have identified contractors that are incorrectly reporting or omitting contractor income.

ASIC pledges to continue online scam blitz

The corporate regulator has revealed online scammers will remain “squarely in the crosshairs”, with 130 investment scams shut down weekly.

ATO to push non-compliant businesses to monthly GST reporting

Small businesses with a history of not complying with their obligations may be moved to monthly GST reporting from the start of April, the ATO has warned.

ATO outlines focus areas for SMSF auditor compliance in 2025

The ATO has issued guidance on what it will focus on regarding auditor compliance for 2025.

https://jimsbookkeeping.com.au/wp-content/uploads/2025/02/Animation-FEB-25.png

295

500

https://jimsbookkeeping.com.au/wp-content/uploads/2019/10/Jims-Bookkeeping-logo-updated-2019-2.png

2025-02-28 00:00:002025-02-07 16:35:55Best Selling BOOKS of all Time

https://jimsbookkeeping.com.au/wp-content/uploads/2025/02/Animation-FEB-25.png

295

500

https://jimsbookkeeping.com.au/wp-content/uploads/2019/10/Jims-Bookkeeping-logo-updated-2019-2.png

2025-02-28 00:00:002025-02-07 16:35:55Best Selling BOOKS of all Time

Have you considered spouse contribution splitting?

Your individual total super balance as of 30 June each year impacts your ability to implement various super strategies in the following financial year.